Federal and state law requires that Registered Investment Advisors are held to a Fiduciary Standard. This law requires that an advisor act solely in the best interest of the client, even if that interest is in conflict with the advisor’s financial interest. Investment Advisors must disclose any conflict, or potential conflict, to the client prior to and throughout a business engagement. Investment Advisors must adopt a Code of Ethics and fully disclose how they are compensated.

Unfortunately, only a small proportion of “financial advisors” are federally or state-registered Investment Advisors. Most so-called financial advisors are considered “Broker-Dealers” by the United States “Securities and Exchange Commission” (SEC). They are held to a lower standard of diligence on behalf of their clients. In fact, they are required by federal law to act in the best interest of their employer, not in the best interest of their clients.

Because broker-dealers are not necessarily acting in your best interest, the SEC requires them to add the following disclosure to your client agreement. Read this disclosure, and decide if this is the type of relationship you want to dictate your financial security:

“Your account is a brokerage account and not an advisory account. Our interests may not always be the same as yours. Please ask us questions to make sure you understand your rights and our obligations to you, including the extent of our obligations to disclose conflicts of interest and to act in your best interest. We are paid both by you and, sometimes, by people who compensate us based on what you buy. Therefore, our profits, and our salespersons’ compensation, may vary by product and over time.”

If this disclaimer appears in agreements you are signing, you should ask questions of your advisor. Obtain complete disclosure about how he or she is compensated, and where his or her loyalties lie. Then decide if the relationship is in your best interest. What does it means to work with a Fiduciary Financial Advisor? Please check out the “Focus on Fiduciary” link for information from NAPFA’s (National Association of Personal Financial Advisors) Education Foundation.

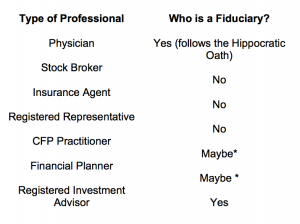

WHO IS A FIDUCIARY?

Fiduciary responsibility does not arise only in the financial services industry. Professionals in other fields also are legally required to work in your best interest.

*Advisors who are affiliated with a broker-dealer firm are most likely not fiduciaries. If the client signs an NASD binding arbitration agreement (which is required by almost every broker-dealer firm), then the firm’s advisors would not be held to a Fiduciary Standard by the North American Securities Dealers. CFP Practitioners and Financial Planners will be held to a Fiduciary Standard if they are also Registered Investment Advisors (RIA) or associated with an RIA.

HOW COMPENSATION IS RELATED TO FIDUCIARY CONDUCT

One of the best ways to judge if your financial advisor is held to a Fiduciary standard is to find out how he or she is compensated.

Fee-Only Compensation –

A Fee-Only financial advisor charges clients directly for his or her advice and/or ongoing management. No other financial reward is provided, directly or indirectly, by any other institution. Fee-Only financial advisors are selling only one thing: their knowledge.

Fee-Based Compensation –

This popular form of compensation is often confused with Fee-Only, but it is very different. Fee-Based advisors earn some of their compensation from fees paid by their client. But they may also receive compensation in the form of commissions or discounts from financial products they are licensed to sell. Furthermore, they are not required to inform their clients in detail how their compensation is accrued. The Fee-Based model creates many potential conflicts of interest, because the advisor’s income is affected by the financial products that the client selects.

Commissions –

This type of advisor is not paid unless a client buys (or sells) a financial product. A commission-based advisor earns money on each transaction—and thus has a great incentive to encourage transactions that might not be in the interest of the client. Indeed, many commission-based advisors are well-trained and well-intentioned. But the inherent potential conflict is great.

"The Fiduciary Difference." Focus On Fiduciary. N.p., n.d. Web. 16 Dec. 2015."

Clarity Coaching Tips

Clarity Coaching Tips Common Sense Videos

Common Sense Videos It’s Your Money

It’s Your Money